On March 22, Polymarket traders were betting on whether a US-Ukraine mineral deal would be finalized by March’s end. The market hovered between 15-20c—reflecting a 15-20% probability—as the two countries prepared for talks in Saudi Arabia to discuss the Russo-Ukrainian war. Yes holders hoped the deal might be finalized during the summit; No holders were betting it wouldn’t happen that fast.

As traders were looking through the news for clues about the summit, the largest Yes holder—holding over 200k shares (let’s refer to him by a pseudonym: “2Barack“)—made an unexpected move. He paid $3k in collateral to try to force a Yes resolution,1 triggering a process where UMA oracle token-holders would decide the market’s outcome.

Crucially, 2Barack submitted the proposal on a weekend, openly telling another trader that this was to avoid a Polymarket clarification opposing the Yes outcome. He also timed it around 8pm EST to reduce the window for No holders to mobilize in UMA's Discord before voting began.

Two days later, UMA declared that the deal had been made, resolving the market to Yes—regardless of the Saudi meeting.

The price jumped from 16c to 100c, reallocating $500k+ from No to Yes holders. After some trading in between, 2Barack reduced his losses by a whooping ~$140k. Others who had pushed the Yes argument during the UMA dispute also walked away with tens of thousands in gains.

So, was it a scam?

What did really happen?

The timeline of the events:

Sept 2024 – Zelensky first floats the mineral deal.

Early Feb 2025 – Trump takes interest and moves things forward.

Feb 25 – Media publishes the deal’s full text.

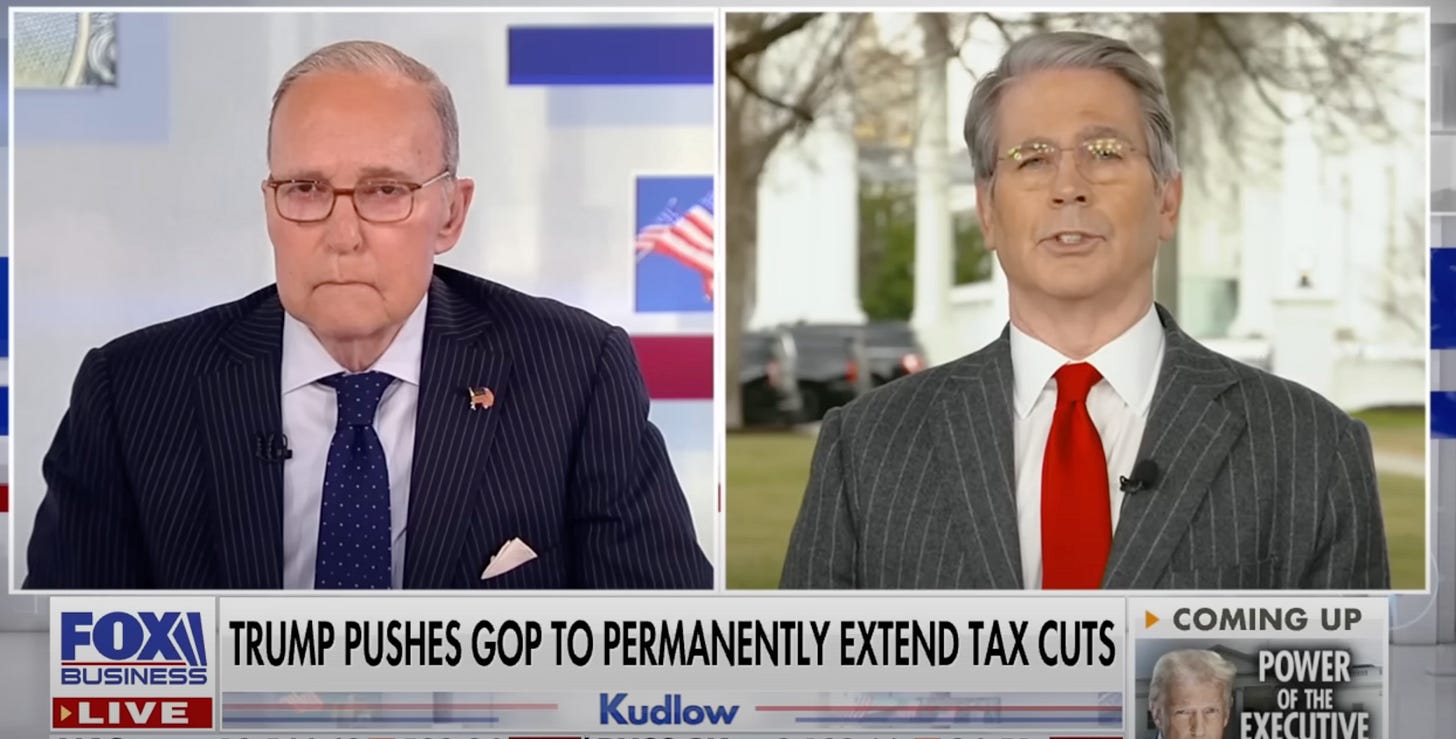

Feb 27 – U.S. Treasury Secretary Scott Bessent says on Fox Business:

We’ve struck a deal. It’s approved by Ukraine’s governing council. It’s done. Just awaiting the presidents’ signatures.

Importantly, the Polymarket rules allowed for resolution based on an “announcement” of a deal—even if it wasn’t enacted. Thus, the core questions became: What qualifies as a “deal,” and what does “announcement” without “enactment” really mean?

Some believed Bessent’s statement was already enough to resolve the market to Yes. The rules didn’t mention signatures. Still, Yes holders like 2Barack preferred to wait for the expected signing the next day to avoid a dispute.

But on Feb 28, during a meeting at the White House, Zelensky clashed with Trump and JD Vance. The signing didn’t happen.

The market crashed from 98c to 40c.

Another market with an identical question—but ending on Friday, Feb 28—resolved to No—no deal was made. No one disputed that outcome.

The calm before the storm

At this point, things seemed calm and straightforward. The Friday market resolved to No. The April market hovered low, reflecting consensus: no deal had been finalized.

Polymarket even launched a new market: “Will the deal be made without Zelensky apologizing to Trump?” This implicitly acknowledged that the deal hadn’t gone through.

Some Yes holders later argued that this new market could’ve been created for a second deal—after the original deal was made but fell through. While theoretically possible, this seems entirely implausible given that Feb 28 market resolved N and no one protested it.

Through March, the price in the April market fluctuated as no one really knew if the deal would still be signed despite the White House debacle. As the month-end neared, it stabilized at 15-20c. The Saudi meeting was possibly the last realistic chance for Yes holders.

This is when 2Barack and others made their move. With the chances of the deal getting finalized within the last 10 days being small and the Yes traders in question having collectively $300k+ to gain from the market going Yes, they decide to try to resolve it as is.

Although there had been no new info supporting the Yes side for weeks, on March 22, 2Barack filed a resolution proposal based purely on Bessent’s Feb 27 comments.

UMA vote

In UMA’s Discord, early comments mostly pushed the Yes narrative—arguing that the deal had been announced, and enactment wasn’t necessary.

Here lies the linguistic trap: “enactment” has two common meanings. As per Oxford’s Dictionary, one, “to pass a law;” two, “to put something into effect.” Yes holders leaned on the first, equating enactment with signing of the deal. They argued announcement before any signatures was enough.

But it’s more likely the rule was designed with the second meaning in mind: to prevent disputes if a deal is reached but implementation stalls due to backtracking of the deal—rather than to enable a resolution on an unsigned, failed deal.

Instead, the clause was twisted: the deal collapsed, yet the market was ruled as if it had gone through.

In a razor-thin outcome, 235 UMA voters chose P4 (too early to resolve / no deal), while 233 backed P2 (the deal was made). But P2 won—its voters held more tokens (12M vs 9M). Whether this came from coordinated Yes commentary early on, or simply large holders buying into the narrative, is unclear.

Effectively, UMA’s position was that Polymarket’s intent was not theirs to guess, that the resolution of the Friday market was not relevant, and that deal’s “announcement” alone sufficed.

Polymarket’s clarification—too little, too late

Here comes the twist.

Minutes before the 24h UMA voting window closed, Polymarket issued a clarification: there was no basis to resolve the market to Yes. This was entirely consistent with the probable intent of the market’s rules, the resolved Friday market, and their own newly created apology market.

But by then, it was too late. All UMA voters had already cast their votes. Why the delay? Possibly weekend staffing—exactly what 2Barack counted on.

Why issue it at all, if too late? Possibly to:

Signal to the market that Polymarket would emergency-pause market’s resolution in case UMA votes Yes.

Encourage UMA staff (who hold most tokens) not to reveal their votes, in case they voted Yes.

The latter did not happen however, although Benni from UMA staff admitted that Polymarket was talking to UMA throughout the voting.

Thanks to the clarification, the market did not go above 35c despite the UMA vote was going Yes. Traders reasonably assumed Polymarket would pause the Yes resolution based on their own clarification.

Some, however, decided to take a gamble and bet on the opposite—and bought cheap Yes shares, hoping that Polymarket would not emergency-pause.

Then came the most unexpected turn: Polymarket issued a second clarification—saying the market would resolve per UMA’s Yes vote, not per Polymarket’s own clarification.

Yes holders who bought in at 35c tripled their money. Those who trusted the earlier clarification lost everything.

More importantly, traders throughout March believed they were betting on future real-world events—whether a deal would be struck by month’s end. Not whether UMA might reinterpret past announcements. No seemed far more likely, but the market was resolved Yes.

So, who’s to blame?

Let’s go chronologically.

Rules – “Announcement without enactment” was vague.

Fault: Polymarket.Clarification timing – Too late to impact UMA vote.

Fault: Polymarket.UMA dispute scheduling – Allowing votes within an hour of dispute submission leaves no room for sufficient public discussion or Polymarket clarifications.

Fault: UMA/Polymarket.No request to leave votes concealed – Polymarket could have asked UMA staff not to reveal Yes votes given the clarification.

Fault: Polymarket.Reward-based voting – The early vibe of the dispute leaned Yes, with influential whales such as 2Barack—holding tens of thousands of dollars in shares—publicly backing that outcome. So, the final result reflected voters’ reluctance to lose rewards by going against what they assumed the consensus would be.

Fault: UMA.Failure to pause – Polymarket should’ve emergency-paused to uphold their own clarification and market’s intent.

Fault: Polymarket.

What about 2Barack and others? Personally, I don’t blame them. They played the game within the rules—albeit exploiting every loophole. The real issue is that those loopholes still existed despite many prior controversies.

It’s time for Polymarket to step up their game.

2x $750 for proposing and 2x $750 for disputing through another user, amounting to $3k. Disputing oneself allows to save $500 in case of a lost dispute. The act of self-disputing suggests that 2Barack assumed that his Yes proposal attempt was most likely to fail.

Good article, though some minor corrections.

> Most UMA voters had already cast their votes.

Should say "All UMA voters"

> The latter did not happen however. Perhaps the UMA staff didn’t see the clarification, and/or weren’t contacted directly.

Benni | RL said Poly was talking to UMA throughout the reveal period. And did not direct them to hold their reveals.